When you ship your products with Transdirect, you are shipping with a company who is dedicated to getting your goods from A to B in good condition. For those who require additional warranty for whatever reason, we also offer a range of insurance and warranty packages.

Two of our couriers offer conditional warranties at no extra cost to yourself – these are Couriers Please and Fastway. These warranties are included in the price of the consignment, however, it should be noted these warranties do not cover all products – for more information you will need to review their warranty information on our site.

We also offer our own insurance and warranty through our very own Transdirect Pty Ltd Loss or Damage Insurance cover. This cover is a conditional warranty that comes at an additional cost to your consignment.

What are the conditions of the Transdirect Insurance Cover?

Our insurance cover is available to customers who would like to ensure they will be reimbursed in the event that an item is damaged or lost in transit.

For a full list of the terms and conditions of this policy please refer to our PDS document and our Transit Insurance conditions. Our warranty team can help you with any additional questions – their email is warranty@transdirect.com.au. The insurance cover we offer has two key benefits:

The responsibility is on the carrier (Transdirect) to fulfil our financial responsibility in the case of damage or loss to property in transit.

Your property is insured for the full replacement value (policy limits vary).

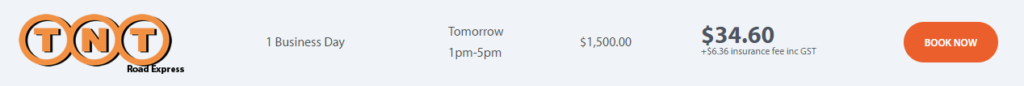

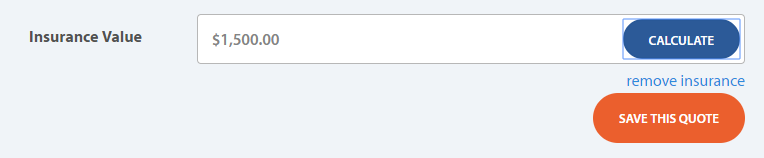

The cost of insurance differs for every package. Our example below is a 5kg small package, with an insurance value of $1500. The additional insurance cost is $6.36.

What is covered by warranty?

For the Transit insurance cover to apply, all goods must be packed at or above the standard set by original manufacturers for this type of transit (you can see details in our PDS). Any damage or loss caused by insufficient packaging will not be covered, and must be valid for transportation using Transdirect (i.e. isn’t a dangerous good). As these policies are conditional, we always recommend reading the individual carrier’s warranty and insurance details to ensure your goods are covered.

What isn’t covered by warranty?

There is a range of items which aren’t covered by warranty. These include (but aren’t limited to):

- Currency of all descriptions

- Bloodstock, animals, exotic birds and pets

- Motor vehicles Including motor bikes/trikes/quad bikes & other

- Second hand Car Parts

- Road/off road vehicles

- Commercial bulk dangerous goods

- Items with existing damage or in poor condition

- Personal effects Including clothing

- Furniture (indoors/outdoors) including but not limited to tables, chairs, lounge suits, mattresses, flat pack furniture, antiques, picture & photo frames, prints, paintings and other works of art

- Explosives

- Live plants and trees

- Second hand goods with existing damage or in poor condition;

- Refrigerated goods, frozen or chilled meat, seafood or foodstuffs

- Glass objects and items containing glass

- China, crockery, marble, quartz, Caesarstone and other stone or imitation stone products, pottery, ceramic, porcelain, bathroom vanity units and toilet suites

- Household goods removals

- Precious metals and stones, money, bullion, cheques, credit or other card sales vouchers, securities, shares, bonds, deeds, bills of exchange or any document that represents money

- Waterborne vessels, jet skis, boats or similar (whether trailed or not).

- Cigarettes or tobacco products

If you are shipping any of these products, you will need to arrange your own third party insurance – contact Australian Risk Applications Pty Ltd on 02 9007 2491.

See our infograph below for the answers to common shipping insurance questions – and remember, you can always contact our warranty team for more information.

We also have a few blogs on the topic if you want more information:

- How does ecommerce shipping insurance work in Australia?

- 6 things you must know about postage insurance